The United States and Canada have long enjoyed a special relationship forged by shared geography, similar values, and strong economic ties. They share the longest international border (at 5,525 miles) and the strongest bilateral trade relationship (with nearly $2.6 billion exchanged every day) of any two countries in the world. Despite some challenges in recent years – such as domestic economic anxiety, COVID-19, and national security concerns – the two countries retain a partnership model unlike any other. In fact, the U.S. continues to be the primary source of goods imported into Canada, with China a distant second.

One obvious reason for this influx of goods is the relative ease of transporting items from one country to another via truck – a process that’s supported by more than 120 land ports of entry lining the border. But despite this proximity, the two countries are still separated by a border – and each nation has its own set of shipping rules and regulations that companies must follow.

For any company looking to move products between the U.S. and Canada, it’s important to understand the various mechanisms involved. It’s also helpful to learn some of the history and factors that have shaped the relationship over the years.

How it All Began

Free trade was first established between the two countries while Canada was still under British control – via the Reciprocity Treaty of 1855. But it didn’t last long. The United States Congress voted to cancel the treaty in 1866, leading to generations of debate and political maneuvering.

Trade with the United States was the primary topic of the 1911 Canadian federal election, where it was proposed by the Liberal Party of Canada. But the Liberals lost the election, and the issue of free trade did not rise to the same level of national prominence in Canada for decades.

From 1935 to 1980, the two nations entered several bilateral trade agreements that greatly reduced tariffs in both nations. During this time, many economists studied the effects of a free trade agreement between the two countries, with many concluding that Canada’s GDP would benefit enormously from the removal of trade barriers. Others voiced concerns about lost capital and job insecurity due to international outsourcing. It was not until the signing of the Canada-United States Free Trade Agreement (CUSFTA) in 1987 that free trade was once again formalized between the two countries.

As stated in the agreement, the main purposes of the Canadian-United States Free Trade Agreement were to:

- Eliminate barriers to trade goods and services between Canada and the United States.

- Facilitate conditions of fair competition within the free-trade area established by the agreement.

- Significantly liberalize conditions for investment within that free-trade area.

- Establish effective procedures for jointly agreement and resolving disputes.

- Lay the foundation for further bilateral and multilateral cooperation to expand and enhance the agreement’s benefits.

Where Things Stand Today

Currently, the United States and Canada boast the world’s largest and most comprehensive trading relationship – one that supports millions of jobs in each country. In most industry sectors, Canada is a highly receptive market for U.S. products and services, with Canadians spending more than 60% of their disposable income on imports from the U.S. This consistently makes Canada a top U.S. export market, accounting for 17.5% of all exported U.S. goods. In 2022, U.S. exports of goods to Canada totaled $328.2 billion, up from $307.8 billion in 2021.

Moving Beyond NAFTA

The global economic landscape has changed significantly since the adoption of the North American Free Trade Agreement in 1994. Since the terms of the original agreement did not reflect these changes, a process began in 2016 to address imbalances in key industries in the U.S., Canada, and Mexico. After four years of negotiations and revisions, a final trade deal – the United States-Mexico-Canada Agreement (USMCA) – was ratified in early 2020 and entered into force on July 1 of that year.

Essentially, the USMCA constitutes a new free trade agreement among the United States, Mexico, and Canada – one with the goals of creating a more balanced environment for trade, supporting high-paying jobs, and growing the North American economy.

Some of the most impactful differences include:

- A requirement on automakers to have 75% of their auto parts manufactured in one of the three countries

- Increased labor law requirements for Mexican workers

- Expanded US and Canadian dairy markets

- Improved intellectual property laws

Less than two years after taking effect, the agreement appears to be playing a positive role in boosting trade flows. This is much in line with expectations; a 2019 report by the U.S. International Trade Commission anticipated an increase in U.S. exports of 5.9% across the region – actual trade from 2019 to 2021 increased an average of 6%.

Canada and Mexico remain the two largest international trade partners for the U.S., ahead of China. And despite a slowdown in 2020 due to the pandemic, 2021 saw strong trade throughout North America. In fact, 75% of Canadian and Mexican imports came from the U.S., marking a new record.

Total trade flows among the three countries reached $1.3 trillion in 2021, and in the first five months of 2022, trade in the region reached $642.6 billion. This represents an increase of more than 23% compared with the same period 12 months earlier.

That’s not to say the process has been without its issues. As with any trade agreement, there will always be disagreements and differences of opinion. In the past two years, disputes have arisen among the three countries over issues such as Canadian dairy tariffs, U.S. solar panel duties, and, most recently, rules of origin for vehicles. But overall, the agreement is showing mutual benefits for the countries involved.

Despite these recent upticks in trade, the North American supply chain remains a complex system with many opportunities for mistakes, delays, and other issues. And there are several challenges cross-border shippers face when trying to move their products to customers. Some of the most common include:

Insufficient documentation

Lack of documentation or insufficient documentation prevents a service provider from setting up a preclearance, which happens prior to the shipment ever being loaded to move across the border. In the past, drivers would present documents to customs officials at the U.S.-Canada border. Now, this process takes place prior to the shipment ever being loaded (Averitt, for example, begins working on this process the day of pickup).

Delays often occur when service providers receive a shipment with no commercial invoice/documentation or missing customs broker information. This can cause the shipment transit time to be severely impacted because your service provider has to track down all of the missing information.

When a shipment is set up for preclearance, the driver will present the documents for the shipment with a Pre-Arrival Review System (PARS) [Canada] or Pre-Arrival Processing System (PAPS) [US] barcode, alongside the commercial invoice and other customs-related documentation. Customs will scan the PARS/PAPS to determine if the shipment has been cleared to be released or whether further inspection is required.

Unknown or inexperienced carriers

In choosing a cross-border transportation provider, shippers can either work directly with a carrier or freight forwarder, or use a 3PL or freight broker that specializes in cross-border shipping. Whichever method you choose, having a strong relationship with your provider is a vital component of smooth cross-border shipping. If a carrier isn’t vetted sufficiently, you run the risk of having customs authorities turn your load away altogether.

This can happen for a variety of reasons that have nothing to do with shipment paperwork or regulatory compliance. For instance, the drivers hauling your freight must have a valid passport and be in good standing with the customs authorities. If a driver has a criminal record, previous border infractions, or a history of substance abuse, they may not be permitted to cross the border at all. Relying on experienced, vetted carriers will go a long way toward reducing delays and hang-ups at the border.

Inexperienced customs brokers

Any freight crossing the border is subject to cargo examination. These inspections can often result in unwanted delays. Although often unavoidable – particularly for certain freight categories – this inspection process can be made far smoother when handled by an experienced in country customs broker. While it’s possible to clear your own shipments through customs, the risks generally aren’t worth the reward – rules and regulations change all the time, and any misunderstandings can lead to costly penalties or delays.

Not only are experienced brokers responsible for knowing these rules, but they also take the burden off your shoulders by coordinating with inspectors and facilities to ensure that your freight is released in a timely manner.

As you can see, there’s no shortage of paperwork and regulations to be mindful of when shipping across the border. So how can you avoid some of the most common cross-border shipping mistakes? Here are a few tips to get you started.

Make sure you have all the necessary documents

Simply having all the documents ready and filled out correctly is probably the single most important part of ensuring a swift and smooth border crossing. Mandatory documents include:

Bill of Lading (BOL) – This contains the essential details about a shipment, such as the freight’s description, size, and weight, as well as contact information for the shipper.

Certificate of Origin – This document shows your shipment’s proof of origin. Importers frequently mistake the country of origin as the country from where the goods were shipped or the country where the assembly of goods took place. But simple assembly (such as packing, painting, or washing of parts) doesn’t determine the country of origin.

Shipments between the U.S. and Canada do not require a certificate of origin unless the importer is wanting to claim duty-free benefits from USMCA. If the goods qualify for USMCA, then a USMCA Certificate of Origin should be completed and included. Otherwise the exporter should just note the country of origin on the commercial invoice.

Commercial Invoice or Canada Customs Invoice (CCI) – This document helps the importer clear the shipment with customs. Much like the BOL, the commercial invoice contains a description of the goods, seller, buyer, and shipment value.

Make sure you accurately fill out your USMCA certificate

This document is used by the U.S., Canada, and Mexico to determine if imported goods are eligible for reduced or eliminated duty as specified by the USMCA. Correctly completing a USMCA Certificate of Origin can be confusing for those who’ve never done it, or who don’t understand the requirements of each field.

The USMCA Certificate of Origin must be completed and certified by an authorized signatory of the producer or exporter of the goods. An incomplete or incorrectly completed certificate invalidates the ability to claim the lower preferential rate of duty that would have been awarded with a valid certificate.

Authorized Economic Operator (AEO) programs, which meet World Customs Organization security standards, allow cross-border carriers to ensure better shipment security and fewer customs delays. As an example, Averitt is certified in:

…to keep shipments secure and on the move during the cross-border process.

Many carriers sacrifice service in the name of coverage. They might say they offer service direct to Canada, but it’s often in a limited capacity because they operate in only a few of the largest cities.

The Pre-Arrival Review System (PARS) allows brokers to submit information to the Canada Border Services Agency (CBSA) for review and processing before the goods arrive at the border. This helps you stay one step ahead of any issues that may arise and helps expedite the carrier’s release or examination once your driver arrives at the border. The U.S. version of this is the Pre-Arrival Processing System (PAPS).

Whether you’re working with a carrier, freight forwarder, or 3PL, one can’t overstate the importance of having strong distribution networks on both sides of the border. Providers with a robust, asset-based network can not only reduce risk, but also they’re better equipped to deal with the complexities of moving shipments across the border. These challenges can include a range of province-specific compliance requirements and time-intensive federal customs checks at the border.

Since asset-based carriers own and operate their own equipment and employ their own drivers, they’re able to maintain standards of quality and service across their fleet. That means more reliable transit time, as well as fewer hands on the freight on both sides of the border.

A strong cross-border network also adds value in other places throughout the supply chain. For instance, Averitt’s partnerships allow us to provide our customers with extensive warehousing options on both sides of the border. We can also offer intermodal and drop-and-hook options tailored to a customer’s specific needs.

Thanks to our strong relationships with best-in-class Canadian providers, shipping cross-border with Averitt is almost like shipping with no border at all.

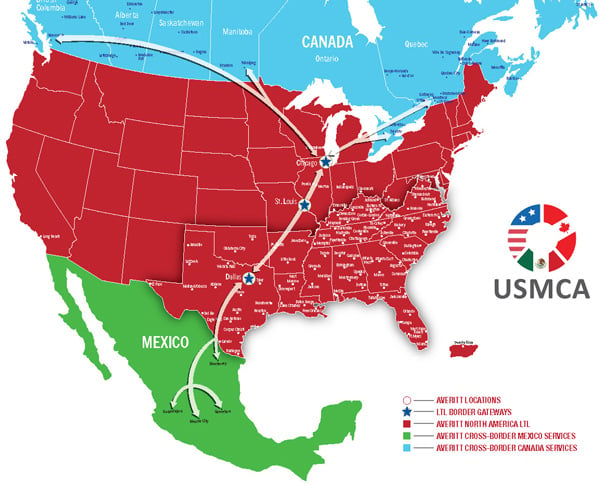

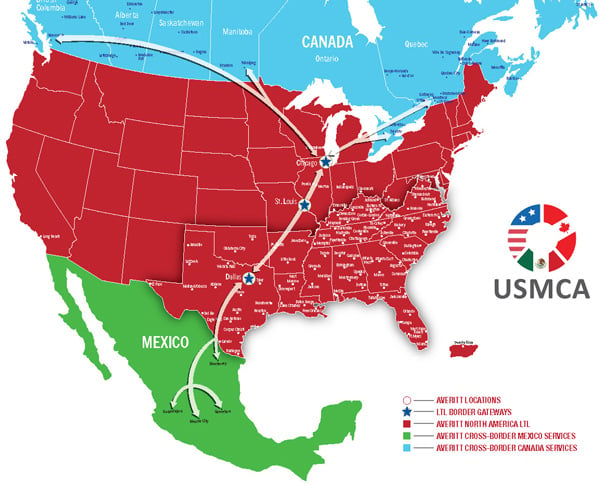

With over 50 years of industry expertise, Averitt can provide your business with complete end-to-end freight and logistics solutions anywhere between the U.S., Canada, and Mexico. We provide reliable on-time service to every major city and market throughout the region – which means you can enjoy a seamless blanket of coverage for virtually any cross-border need.