In late 2023, we carried out the ninth annual State of the North American Supply Chain Survey. With this survey, we aim to gauge the difficulties encountered by shippers over the course of the year and to develop a clearer perspective on their expectations for the upcoming year. Ultimately, over 1,400 shippers from diverse sectors participated and shared their insights.

This survey encompasses various subjects related to logistics and supply chain management, including domestic ground transportation, cross-border shipping, international forwarding, and pressing issues like sustainability.

2024 Outlook: Shippers Anticipate Growth in Freight Volume

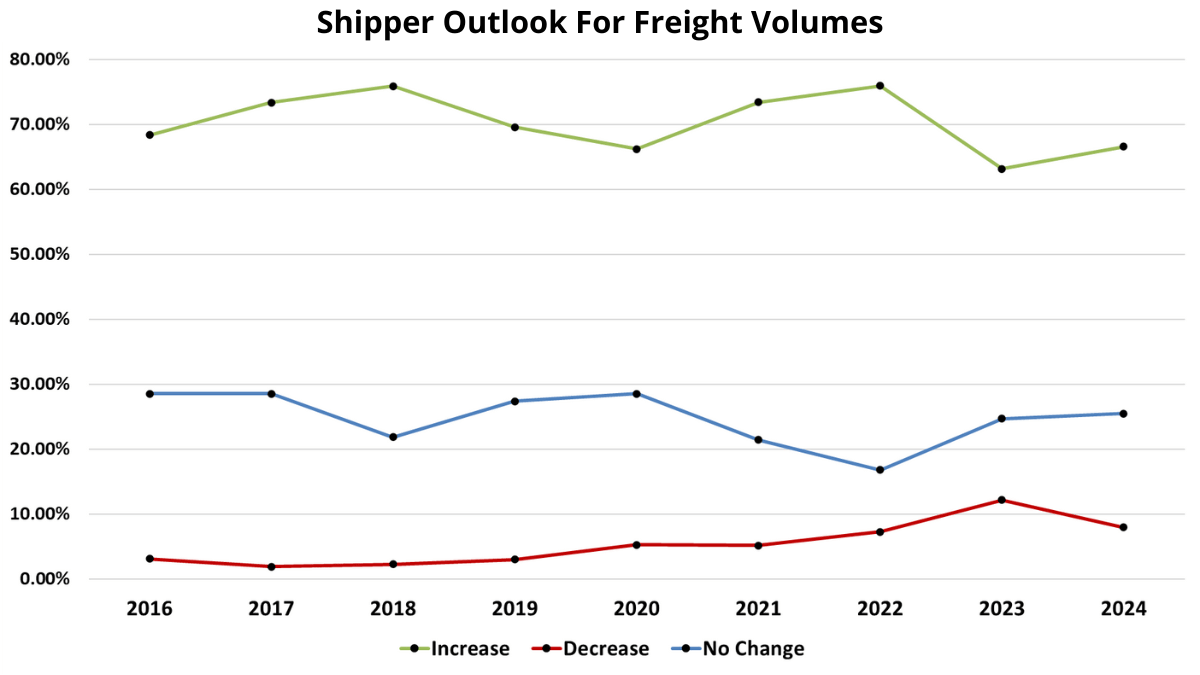

A key question consistently posed each year is whether shippers expect to handle an increased freight volume in the upcoming year compared to the last.

When we posed this question the previous year to measure shipping sentiments heading into 2023, the results marked the largest drop in freight growth over the course of the survey’s history. At that time, shippers projected a 12-percentage-point decline in freight activity in 2023 compared to 2022.

Though the general economy in the U.S. remained resilient throughout 2023, the swift and steep decline in shipping volume was felt within the freight transportation sector. Many players in the industry were forced to close their doors, including Yellow Corporation and Convoy Inc., which made headlines week after week.

In the current survey, 67% of our respondents said they anticipate moving more freight in 2024 than in 2023. This marks a 4-percentage-point gain over the previous year – a positive sign for shippers and carriers alike.

The volume projections for 2024, when contrasted with those of earlier years, suggest a return to a more stable freight economy. This is particularly evident when compared to the turbulent period of 2020-2022, the early years of the pandemic, which were marked by unprecedented uncertainty and a widespread strain on capacity across various sectors.

The bigger question ahead for shippers and the general economy is whether we are entering a period of traditional and sustainable growth compared to the pandemic bubble, which deflated.

Need a printable/sharable PDF of the 2024 State of the North American Supply Chain? Fill out the form below to download the file.

Rail and Air: Interest On The Rise

Following steep declines in projected use in 2023, shippers are showing more interest in alternative transportation modes in the year ahead.

When asked if they planned to use air cargo services in 2024, 26% said yes. This marked a 3-percentage-point increase from the previous year (23%). In line with freight volume projections, this rebound follows the steep declines projected for 2023, when shippers pointed toward a 9-percentage-point decline in use compared to 2022.

In addition to the 26% of respondents who were almost certain they would use air services in 2024, 20% of shippers are also interested in or considering using this mode.

Following a similar pattern of anticipated growth, rail (or intermodal service) service use is also expected to increase, by 3 percentage points. From projections of 17% in 2023 to 20% in 2024, interest in rail services returns to a level not seen since the question was asked in 2019, the year before the pandemic.

Last year saw the first major railroad merger in more than two decades. The formation of CPKC brought together Canadian Pacific and Kansas City Southern to form the first transnational rail network on the continent. With a footprint that spans across Canada, the U.S., and Mexico, the merged CPKC comes at a time when more businesses are nearshoring operations to Mexico.

Though the new line promises to increase transportation efficiency with cross-border trade, challenges with increased migration across the U.S.–Mexico border also led to suspensions of vital rail service operations in Texas port cities such as El Paso and Eagle Pass, in December.

There may be challenges ahead for cross-border rail service, but there are also further investments in infrastructure that will entice more shippers to use the mode. Late last year, for example, Georgia Ports Authority announced plans to open a second inland rail terminal in Gainesville, Georgia, that will link to the Port of Savannah.

Top of Mind: Sustainability At Every Turn

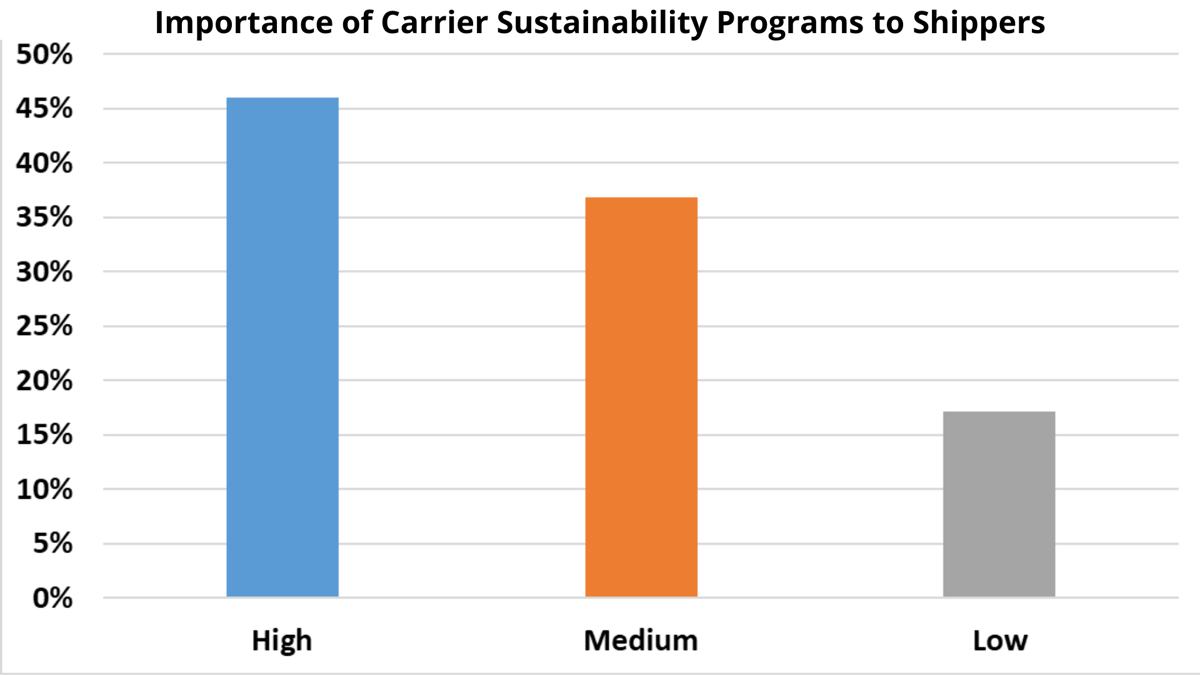

For the first time in the survey, we asked shippers how important a carrier’s sustainability program is to their decision-making process.

Among them, 46% said it was of high importance, 37% said it was of medium importance, and 17% said it was of low importance.

Sustainability initiatives in the transportation industry are becoming increasingly vital for shippers and businesses involved in freight movement, primarily due to a combination of environmental, economic, and regulatory factors.

Firstly, the environmental impact of trucking, a significant contributor to greenhouse gas emissions, is a major concern. By adopting sustainable practices, trucking carriers can significantly reduce their carbon footprint to align with global efforts to combat climate change. This is not just beneficial for the environment, but also aligns with growing consumer and investor demand for environmentally responsible business practices.

Moreover, governments around the world are tightening environmental regulations. Working with carriers that adhere to these regulations is essential for shippers to avoid legal penalties and ensure smooth operations. Additionally, sustainable practices often lead to increased operational efficiency and cost savings, such as through fuel-efficient driving, the use of alternative fuels, and improved route planning.

Corporate responsibility and brand image are also at stake. In an era where sustainability is a key consumer concern, companies that prioritize green practices in their supply chain can enhance their reputation and appeal to a broader customer base. This approach also aligns with an increasing focus on environmental, social, and governance (ESG) criteria among investors, making companies with strong sustainability practices more attractive for investment.

At the same time, sustainability concerns within the transportation industry extend beyond traditional trucking operations. At a recent COP28 United Nations climate change conference in Dubai, the U.S. and Canadian governments made a joint announcement that they would seek ways to reduce the greenhouse gas emissions of the railways via a task force.

These factors, among others, will continue to bring sustainability initiatives to the forefront of discussions between shippers and their supply chain and logistics partners.

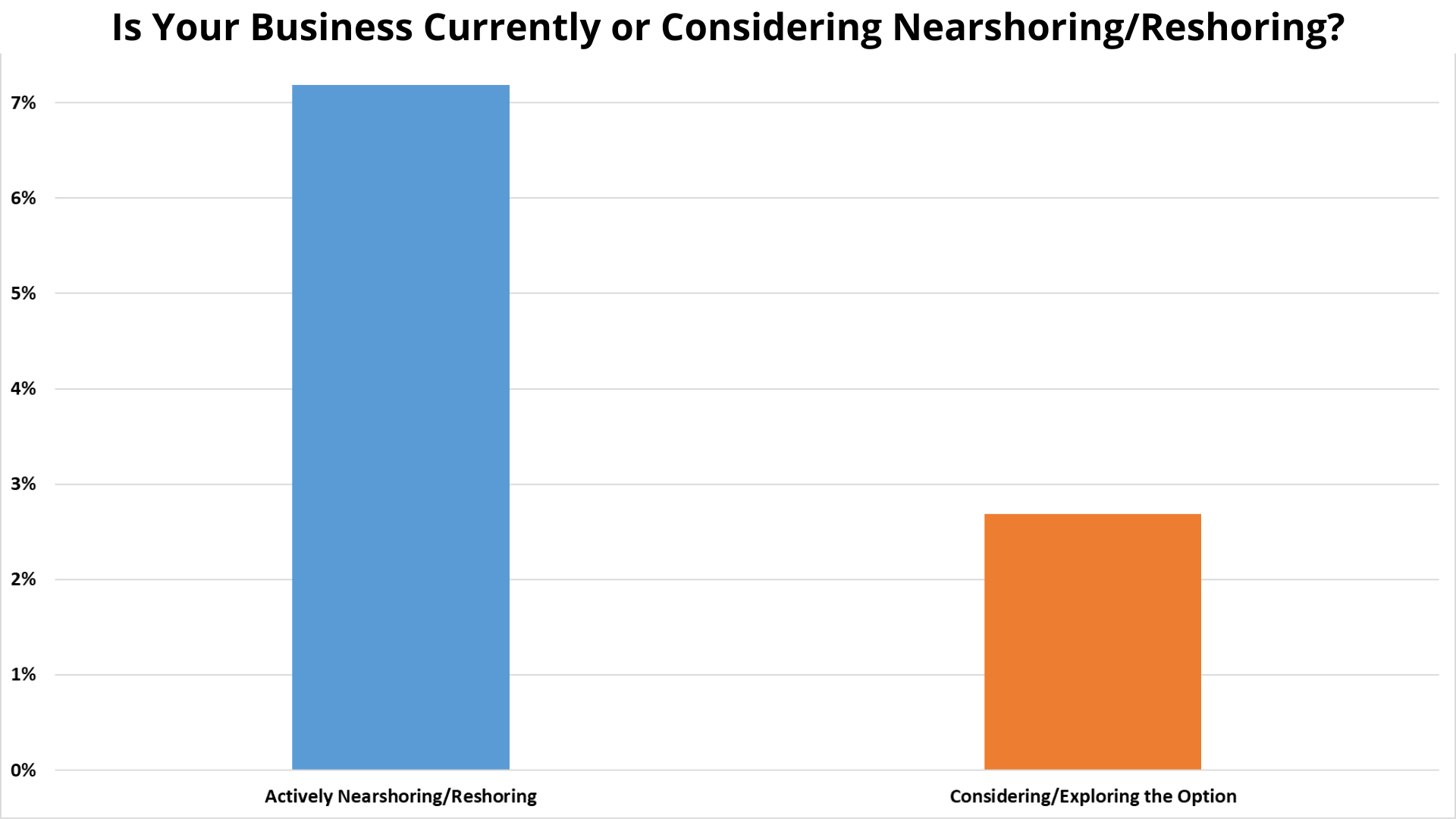

Nearshoring and The Impact on Cross-Border Trade

Over the past few years, a growing number of supply chains have shifted manufacturing operations to Mexico. Driven in part by benefits provided by the United States–Mexico–Canada Agreement (USMCA) and geopolitical tensions abroad, supply chain nearshoring and reshoring is on more minds than ever before.

In this survey, we asked shippers for the first time if they were currently or actively exploring the option of nearshoring or reshoring parts of their supply chain to North America. In response, 7% said they had already brought back all or some of their operations to North America, and 3% said they were currently considering or exploring the option.

Due to its proximity to the U.S. and reasonably low labor costs, Mexico (the northern region in particular) is a big winner when it comes to nearshoring. In 2023, the country surpassed China as the top trading partner with the U.S. month after month.

Investments flowing into Mexico cannot be understated. Tesla, for example, plans to open a $5 billion automotive factory in Monterrey. China, which at first glance may not seem to be a beneficiary of nearshoring, has also invested heavily in Mexico in recent years, pouring hundreds of millions of dollars into plants and regions that export to the U.S.

As manufacturing continues to grow south of the border, businesses in the U.S. and Canada are grappling with supply chain challenges caused by infrastructure and capacity inadequacies. For many years, northbound freight lanes from Mexico into the U.S. have faced tightened capacity constraints. Now the problem is only getting worse, as freight volume continues to grow beyond the equipment and drivers available.

Additionally, as hinted at in the previous section on rail service, shippers are facing increased delays at the border itself. With the surge in migration, border authorities are frequently diverted from inspecting and processing freight at truck and rail crossings to help elsewhere. This means that on top of transit times already slowed down by capacity constraints, cross-border supply chains must also take fluctuating government manpower into account.

There may not be any quick solutions ahead for the challenges in cross-border logistics, but according to Ed Habe, Averitt’s vice president of Mexico sales, transportation diversification should be top of mind.

“Being the last to adapt in supply chain operations is a position no business wants to find itself in,” Habe said in a featured article on FreightWaves. “It’s crucial for companies, especially those dealing with high volumes or industries heavily reliant on speed-to-market, to proactively seek and implement effective methods for diversifying their transportation strategies out of Mexico.”

Looking to streamline your cross-border transportation and logistics needs between Mexico and the U.S.? Watch the short video below to learn about Averitt's Mexico Cross-Border Services!

What'S Happening on the Water?

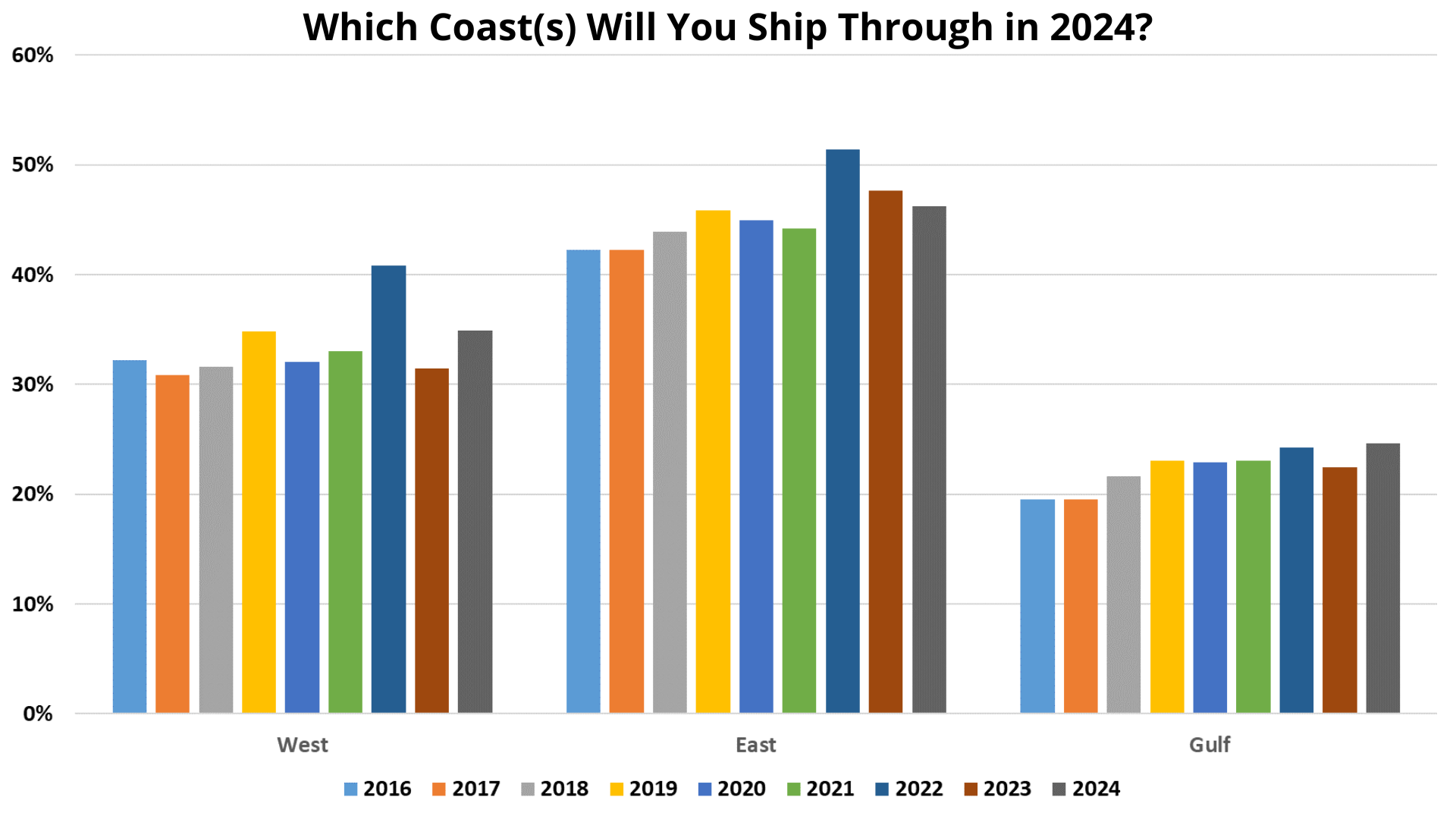

When we asked shippers which coasts they planned to move cargo through in 2024, their responses indicated a small decline for East Coast ports of 2 percentage points from 2023 (48%) to 2024 (46%), and increases for West Coast and Gulf Coast ports.

For West Coast ports, there was a positive rebound of 4 percentage points over 2023 expectations, which came off the heels of a steep 10-percentage-point decline in 2022. That year, many shippers shifted cargo elsewhere due to the extreme congestion along the West Coast that occurred in 2021.

For Gulf Coast ports, the survey recorded a 3-percentage-point gain for 2024 (25%) over 2023 (22%).

When looking beyond shippers’ pandemic-year expectations for 2022, the data does not appear to be too surprising. Given most shippers who took the survey are located east of the Mississippi River, it is expected that the East Coast would surpass the West Coast for cargo moves.

However, the lower expectation for the East Coast versus the higher expectation for the West and Gulf Coasts suggests possible hesitation by some shippers that may have to do with the drought-hit Panama Canal. As a result of recent droughts across the Isthmus of Panama, canal authorities have been forced to reduce the number of ships that can transit at any given time. This has led to delays for some ships originating from Asia bound for the East Coast.

Additionally, tensions across the Middle East, particularly around the Suez Canal, could cause additional shipping disruptions to East Coast volumes in the months ahead. On the other hand, Gulf Coast ports fared better over the course of 2023 thanks in part to exports of raw materials, which helped offset the effects of import declines.

Beyond ports of choice, international shippers reported an uptick in clerical and administrative challenges in 2023. Problems with customs clearance were reported as the biggest headache, with a 5-percentage-point increase in 2023 (29%) over 2022 (24%). Secondly, issues with shipment visibility jumped 7 percentage points in 2023 (19%) over 2022 (12%).

Looking Ahead to 2024

It’s clear that the transportation and logistics landscape is evolving rapidly, with shippers anticipating growth in freight volumes in 2024. This optimism, emerging from the challenges of the past few years, signals a potential return to stability and growth in the freight economy.

The importance of shippers working closely with their transportation and logistics partners in the months ahead cannot be overstated. Collaborative partnerships will be key in navigating the complexities of the modern supply chain, from adapting to sustainability demands to managing the intricacies of cross-border logistics. As we look ahead to 2024, it is crucial for shippers to engage proactively with their partners, leveraging their expertise and insights to optimize their supply chain strategies, ensure compliance with evolving regulations, and capitalize on emerging opportunities.

At Averitt, we’re dedicated to building strong, lasting partnerships that enable our customers to achieve their goals year after year. At every turn in the supply chain, we offer award-winning solutions that are designed to streamline your business and deliver unparalleled efficiency.

Watch the video below to learn more about our "Power of One" approach to enabling your success and contact us today to speak with our team.